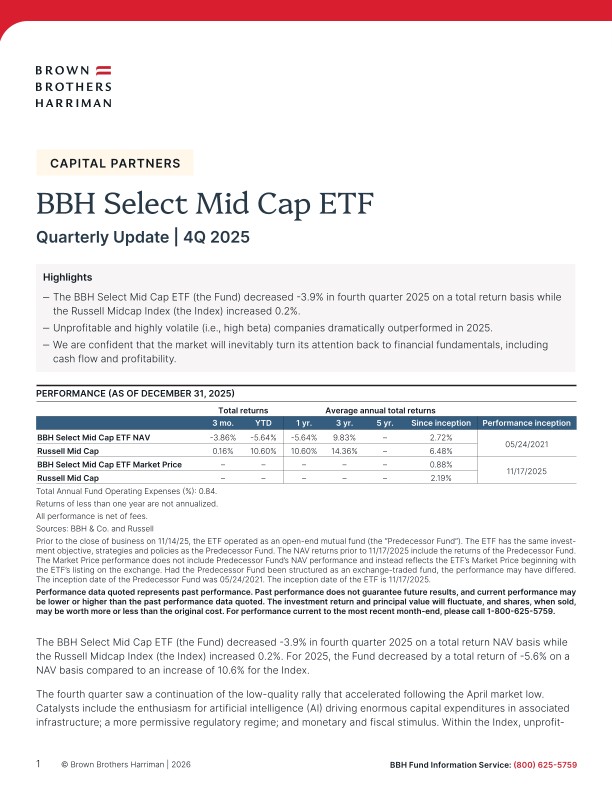

The BBH Select Mid Cap ETF (the Fund) decreased -3.9% in fourth quarter 2025 on a total return NAV basis while the Russell Midcap Index (the Index) increased 0.2%. For 2025, the Fund decreased by a total return of -5.6% on a NAV basis compared to an increase of 10.6% for the Index.

The fourth quarter saw a continuation of the low-quality rally that accelerated following the April market low. Catalysts include the enthusiasm for artificial intelligence (AI) driving enormous capital expenditures in associated infrastructure; a more permissive regulatory regime; and monetary and fiscal stimulus. Within the Index, unprofitable companies have dramatically outperformed and were up 42.9% in 2025.1 Similarly, the quintile with the highest beta to the Index was up 31.9% in 2025.2 This is a difficult market backdrop for our strategy, which focuses on high-quality, profitable companies and avoids speculative ventures.

RISKS

Investors in the Fund should be able to withstand short-term fluctuations in the equity markets and fixed income markets in return for potentially higher returns over the long term. The value of portfolios change every day and can be affected by changes in interest rates, general market conditions and other political, social and economic developments.

The Fund is ‘non-diversified’ and may assume large positions in a small number of issuers which can increase the potential for greater price fluctuation.

Foreign investing involves special risks including currency risk, increased volatility, political risks, and differences in auditing and other financial standards.

Investing in small or medium sized companies typically exhibit greater risk and higher volatility than larger, more established companies.

Securities issued in IPOs have no trading history, and information about the companies may be available for very limited periods. In addition, the prices of securities sold in IPOs may be highly volatile or may decline shortly after the IPO. Asset allocation decisions by a large investor or an investment adviser, particularly large redemptions, may adversely impact remaining Fund shareholders.

For more complete information, visit www.bbhfunds.com for a prospectus. You should consider the fund's investment objectives, risks, charges and expenses carefully before you invest. Information about these and other important subjects is in the fund's prospectus, which you should read carefully before investing.

Shares of the Fund are distributed by ALPS Distributors, Inc. and is located at 1290 Broadway, Suite 1000, Denver, CO 80203.

Brown Brothers Harriman & Co. ("BBH"), a New York limited partnership, was founded in 1818 and provides investment advice to registered mutual funds through a separately identifiable department (the "SID"). The SID is registered with the U.S. Securities and Exchange Commission under the Investment Advisers Act of 1940.

Beta is a measure of the volatility - or systematic risk - of a security or portfolio compared to the market as a whole.

Not FDIC Insured No Bank Guarantee May Lose Money

IM-17827-2026-01-15 BBE000107 Exp. Date 04/30/2026